We seek to realise sustainable value for our stakeholders through the successful delivery of material energy projects in Africa

Our resources and relationships

Investors

57%

Top 10 institutional investors hold 57% of total shares outstanding1.

Lenders

US$581m

Total debt being provided by a group of 10 lenders, plus a listed bond.

Assets2

US$1.5bn

Total Group assets

People3

276

Employees

Total Group assets

- Combined 2P Reserves and 2C Resources of 157.6 MMboe with a reserve life of 25.8 years.

- Two producing oil and gas fields in Nigeria with 23.6 Kboepd average daily production in 2023..

- Nigerian midstream gas business comprising central gas processing facility with 200 MMscfpd production capacity and c. 260 km gas transportation and distribution network.

- Five undeveloped discoveries in Niger, with a total of 146 further potential exploration targets.

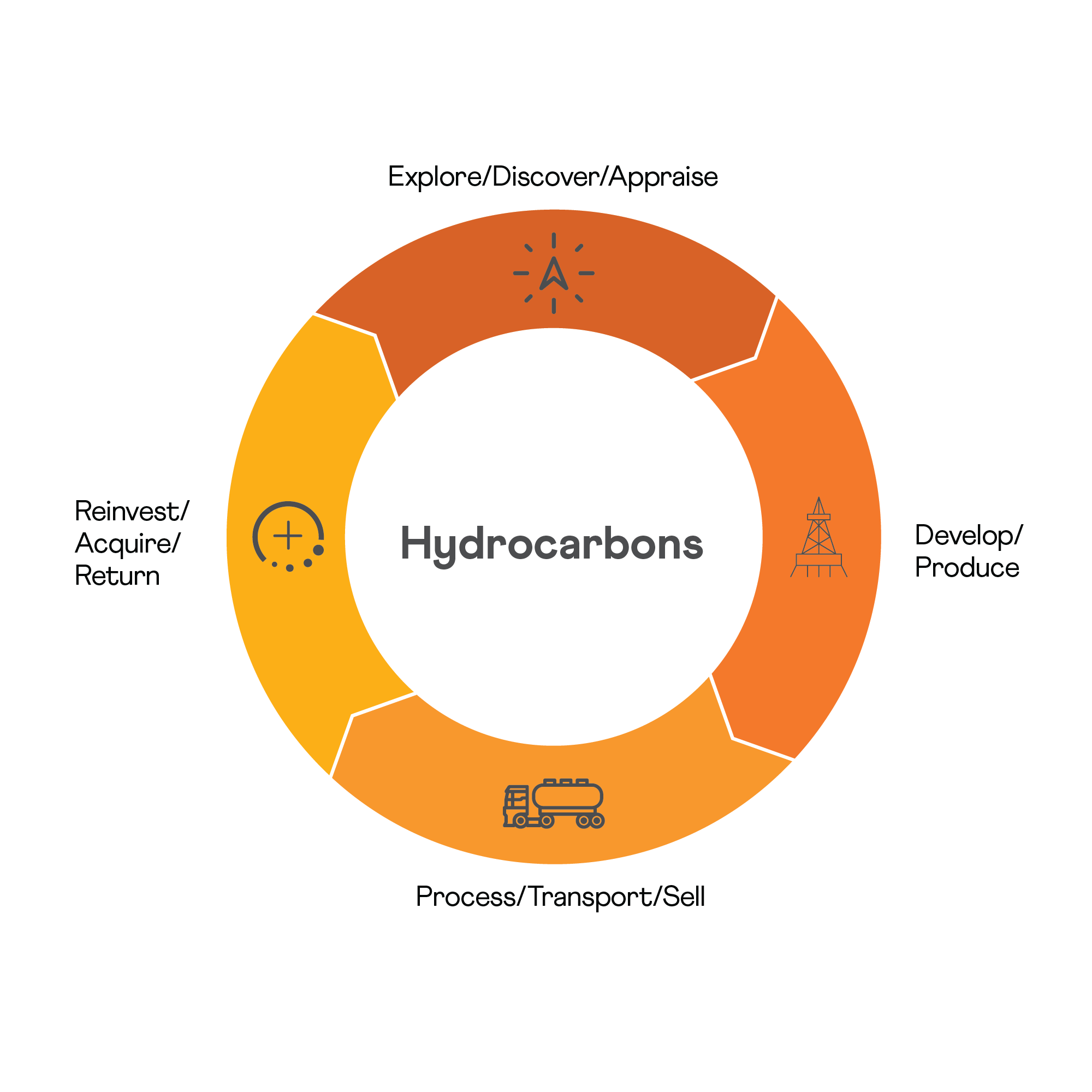

What we do

Through the acquisition of seismic and other geophysical data and detailed subsurface studies, we build exploration portfolios and identify drilling targets. Through exploration and appraisal drilling we find oil and gas reserves and resources to be produced and monetised in the future.

We drill wells and install surface networks to enable oil and gas reserves to be produced.

We invest in infrastructure to process and transport produced hydrocarbons to end customers.

Our reinvestment strategy is to prioritise opportunities that have the potential to deliver high-quality cash flows and are net asset value-accretive. To this end, we expect to reinvest in projects that extend the economic life of our existing asset base and we plan to acquire assets that either have synergies with our existing portfolio, or represent new ventures which are aligned with our corporate purpose and strategy.

We carry out greenfield development by identifying suitable project sites, undertaking resource assessments and obtaining the necessary authorisations. Preliminary engineering is then carried out alongside environmental and social impact studies. We enter into long-term power purchase agreements and construction contracts and then procure project financing.

We construct power generation facilities along with the associated infrastructure required to connect to the electricity grid.

We manage the operational phase which involves the technical and commercial management of the project, with a focus on continued optimisation of energy production.

Our reinvestment strategy is to prioritise opportunities that have the potential to deliver high-quality cash flows and are net asset value-accretive. To this end, we expect to reinvest in projects that extend the economic life of our existing asset base and we plan to acquire assets that either have synergies with our existing portfolio, or represent new ventures which are aligned with our corporate purpose and strategy.

The value we create for our stakeholders

Our people

- Our people received a total of 15,858 hours of training in 2023, equating to an average of 57 hours per employee.

- Lost Time Injury Rate (“LTIR”) of 0.34 recorded in 2022 and a 2022 Total Recordable Incident Rate (“TRIR”) of 0.68 per 200,000 working hours.

- Two million working hours without an LTI since 1 January 2023, achieved post-year end on 3 May 2024.

Our shareholders and lenders

- Operating profit of US$137 million in FY 2023.

Governments, local authorities and regulators

US$218 million of payments to governments in Nigeria and Niger since 2014 7.

Our host countries and communities

- We supply gas to enable approximately 20% of Nigeria’s thermal power generation capacity.

- US$1.7 billion4 investment in Nigeria and Niger assets since 2014.

- US$733 million Total Contributions(d) to Nigeria and Niger since 2014

- Up to 696 MW of renewable energy projects currently in motion.

Our customers, suppliers and partners

- New and extended GSAs during 2023, including a new GSA with Shell Nigeria Gas Limited and contract extensions with Central Horizon Gas Company Limited, First Independent Power Limited, Notore Chemical Industries PLC and Shell Petroleum Development Company of Nigeria Limited for a total of up to 101 MMscfpd.

- Our suppliers in Nigeria include AMOCON, whereby our Accugas subsidiary agreed a 10-year contract to 2033 to purchase up to 20 MMscfpd of gas for onward sale to Accugas customers.

- Successful ongoing partnership with AIIM, a leading Africa-focused private equity firm.

Our values

1. JP Morgan shareholder analysis 28 April 2023.

2. This figure includes the assets in Chad as at 31 December 2022. On 9 December 2022, Savannah’s wholly owned subsidiary, Savannah Energy Chad Limited, completed the acquisition of Savannah Chad Inc. (“SCI”, the former Esso Exploration and Production Chad, Inc.) and Savannah Midstream Investment Limited (“SMIL”, the former Esso Pipeline Investments Limited). On 31 March 2023, the Republic of Chad nationalised SCI’s upstream production assets in Chad and SMIL’s c. 40% interest in TOTCo.

3. This figure includes Savannah employees as at 31 December 2022 in Cameroon, France, Niger, Nigeria and the United Kingdom.

4. This section discusses the principal aspects of the business model we expect to follow, based upon the typical lifecycle of oil and gas and renewable energy projects. This discussion is provided for illustrative purposes only and it should be noted that Savannah is not participating in projects at every stage of the respective project lifecycles as at the date of publication.

5. Includes investment in Nigeria during the period pre-acquisition of the Nigerian assets by Savannah.

6. Total contributions to Nigeria and Niger defined as payments to governments, employee salaries and payments to

local suppliers and contractors. Where total contributions refer to the period 2014–2022 they include contributions

to Nigeria during the period pre-acquisition of the Nigerian assets by Savannah.

7. Where payments to government refer to the period 2014–2022 they include payments to Nigeria during the period preacquisition of the Nigerian assets by Savannah.